Last updated: 12/18/2024

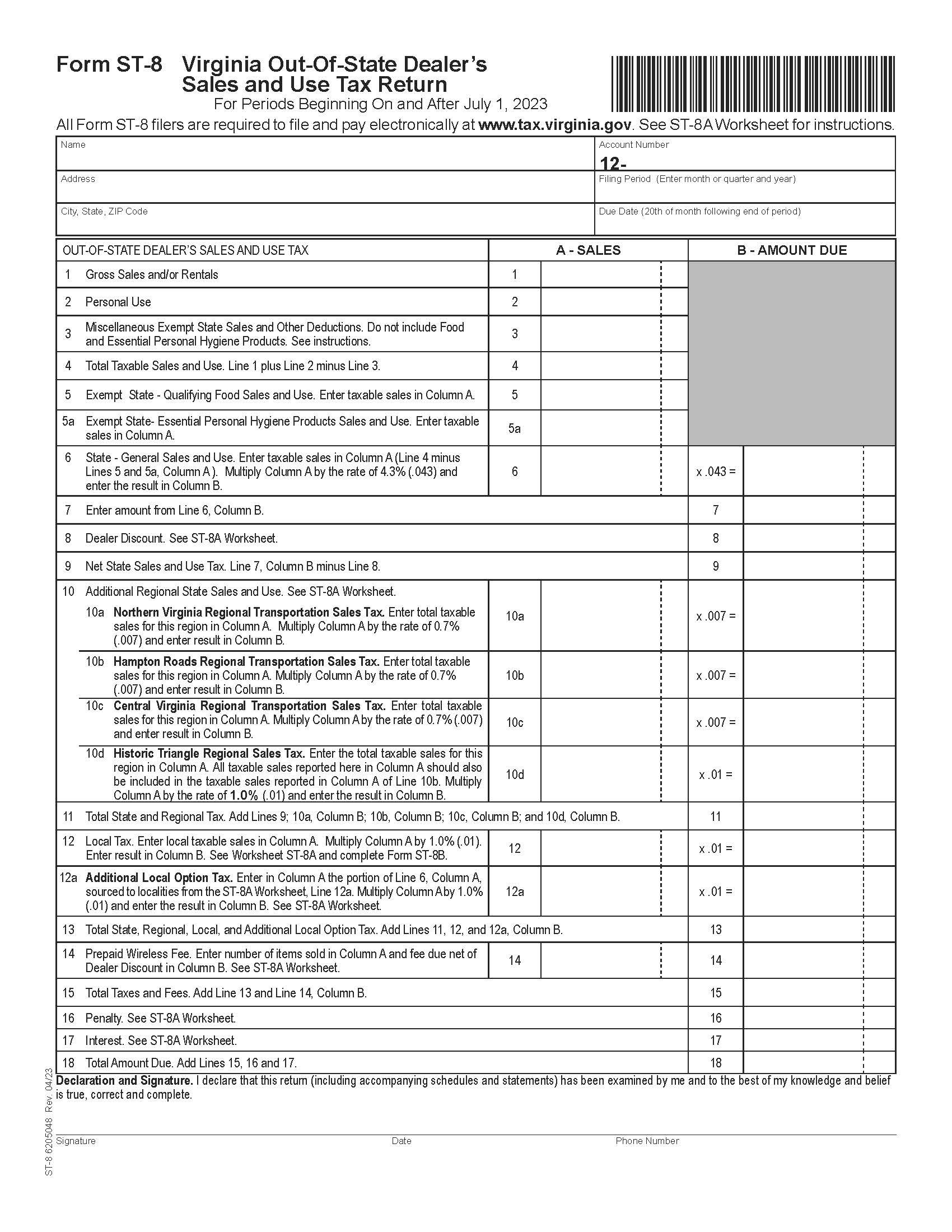

Out Of State Dealers Use Tax Return {ST-8}

Start Your Free Trial $ 29.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

ST-8 - VIRGINIA OUT-OF-STATE DEALER’S SALES AND USE TAX RETURN. This form is used by businesses located outside of Virginia to report and pay sales and use taxes on taxable sales made to customers in Virginia. It is specifically for out-of-state dealers who are required to collect and remit Virginia sales tax due to their sales activities in the state. The form is used for various types of sales, including gross sales, rentals, and exempt sales (such as food or essential personal hygiene products). Out-of-state dealers must calculate and report state, regional, and local sales and use taxes, as well as any additional local option taxes if applicable. The form includes calculations for taxes owed, along with penalties and interest if applicable. www.FormsWorkflow.com