Last updated: 12/26/2023

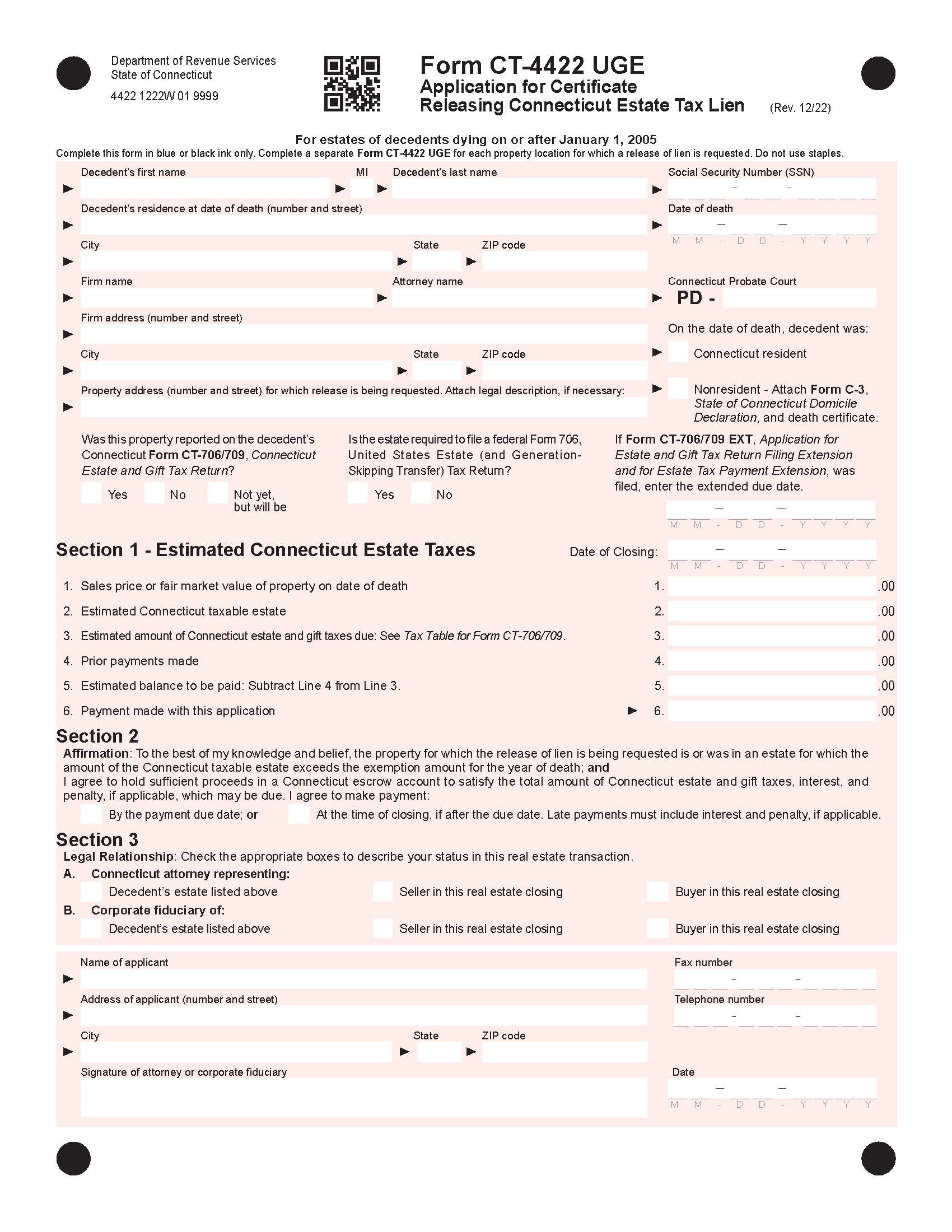

Application For Certificate Releasing Estate Tax Lien {CT-4422 UGE}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form CT-4422 UGE - APPLICATION FOR CERTIFICATE RELEASING CONNECTICUT ESTATE TAX LIEN. This form is used in the state of Connecticut to request the release of a lien on Connecticut real property includible in the decedent’s Connecticut taxable estate. It is specifically used for estates of decedents who passed away on or after January 1, 2005. The form is completed by Connecticut attorneys or corporate fiduciaries representing the decedent's estate, buyers, or sellers in a real estate closing. It requires information about the decedent, the property address, estimated Connecticut estate taxes, and an affirmation of payment responsibility. The form should be filed with the Department of Revenue Services (DRS) either by fax, mail, or in person. Additional instructions and contact information can be found on the form itself. www.FormsWorkflow.com