Last updated: 4/24/2023

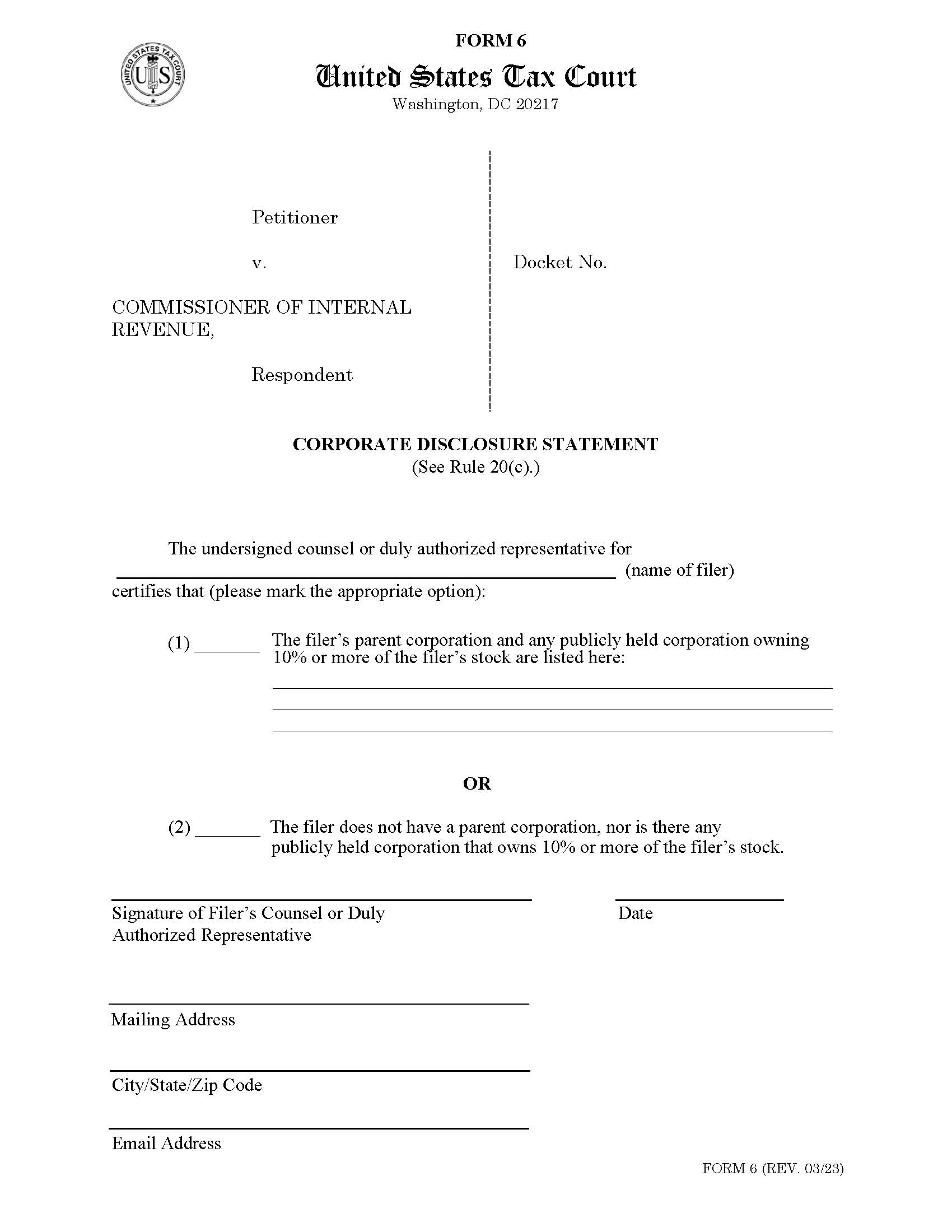

Corporate Disclosure Statement {Form 6}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form 6 - CORPORATE DISCLOSURE STATEMENT (See Rule 20(c).). This form is used in the United States Tax Court for a petitioner to disclose information about its corporate ownership. The form requires the filer to either list the parent corporation and any publicly held corporation owning 10% or more of the filer's stock or certify that there is no such parent corporation or public ownership. This disclosure is to ensure transparency regarding potential conflicts of interest. The form must be signed by the filer's counsel or authorized representative and include contact information. www.FormsWorkflow.com