New York

Local County

New York

NYC

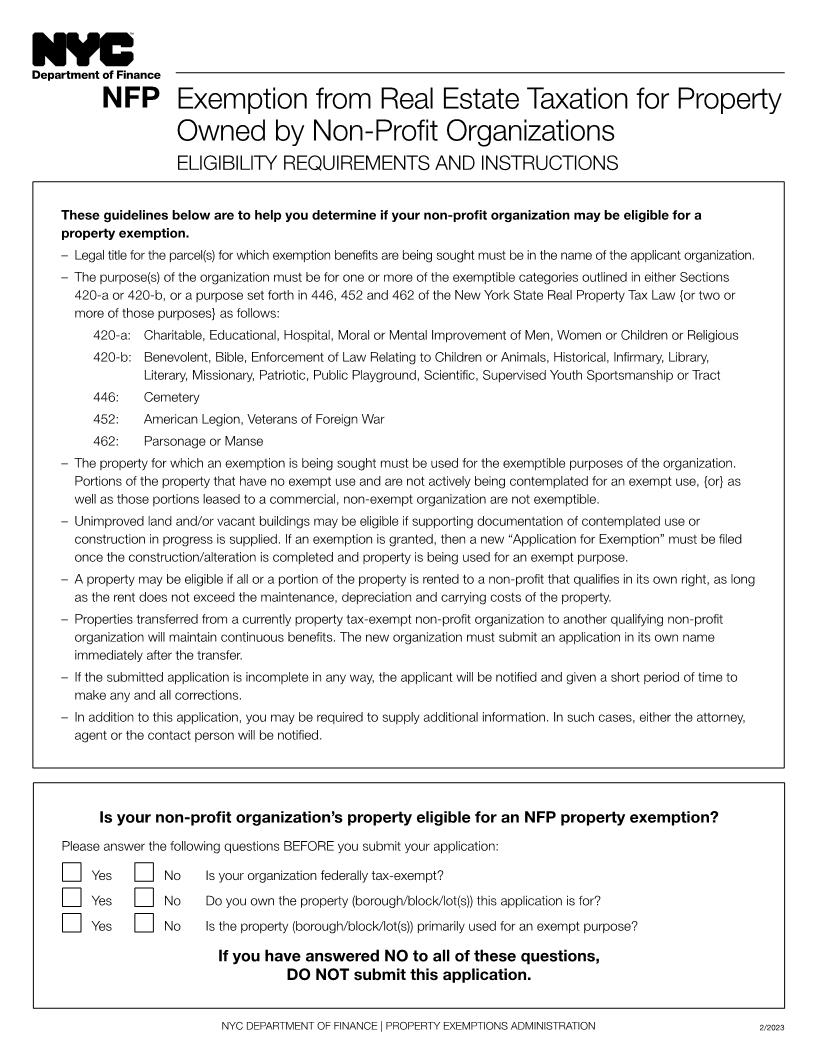

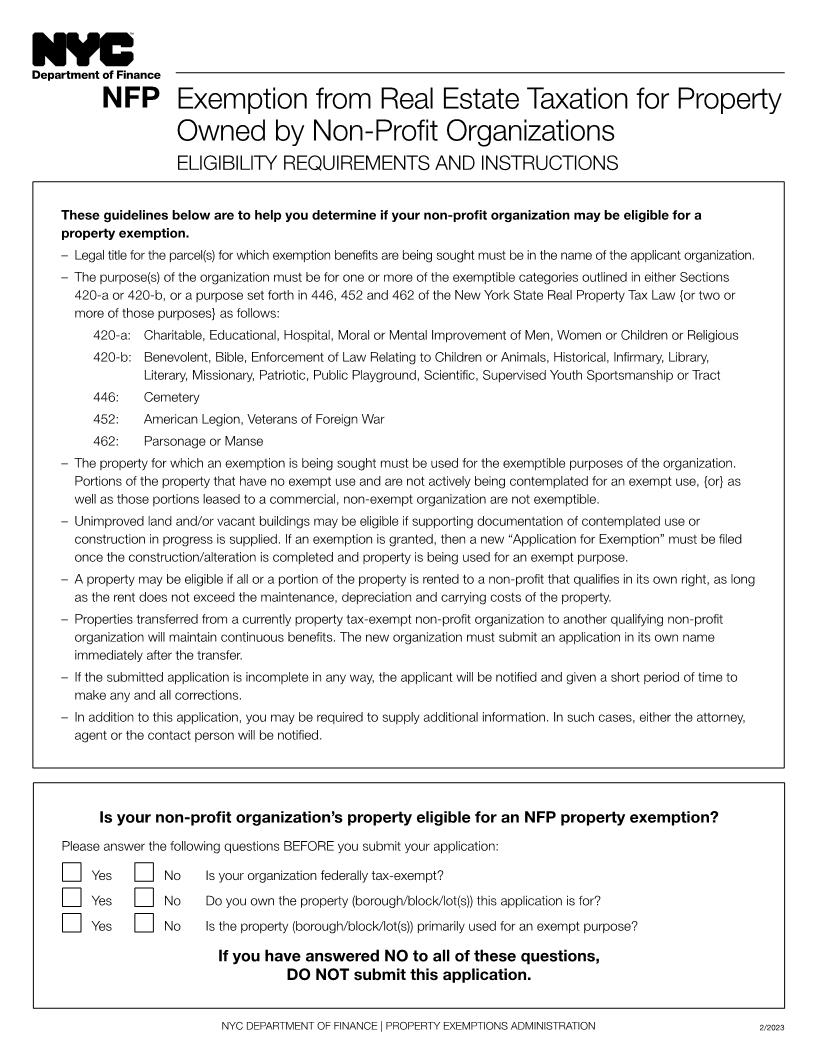

Department Of Finance

Last updated: 5/23/2023

Exemption From Real Estate Taxation For Property Owned By Nonprofit Organizations

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Related forms

Our Products