Last updated: 11/3/2023

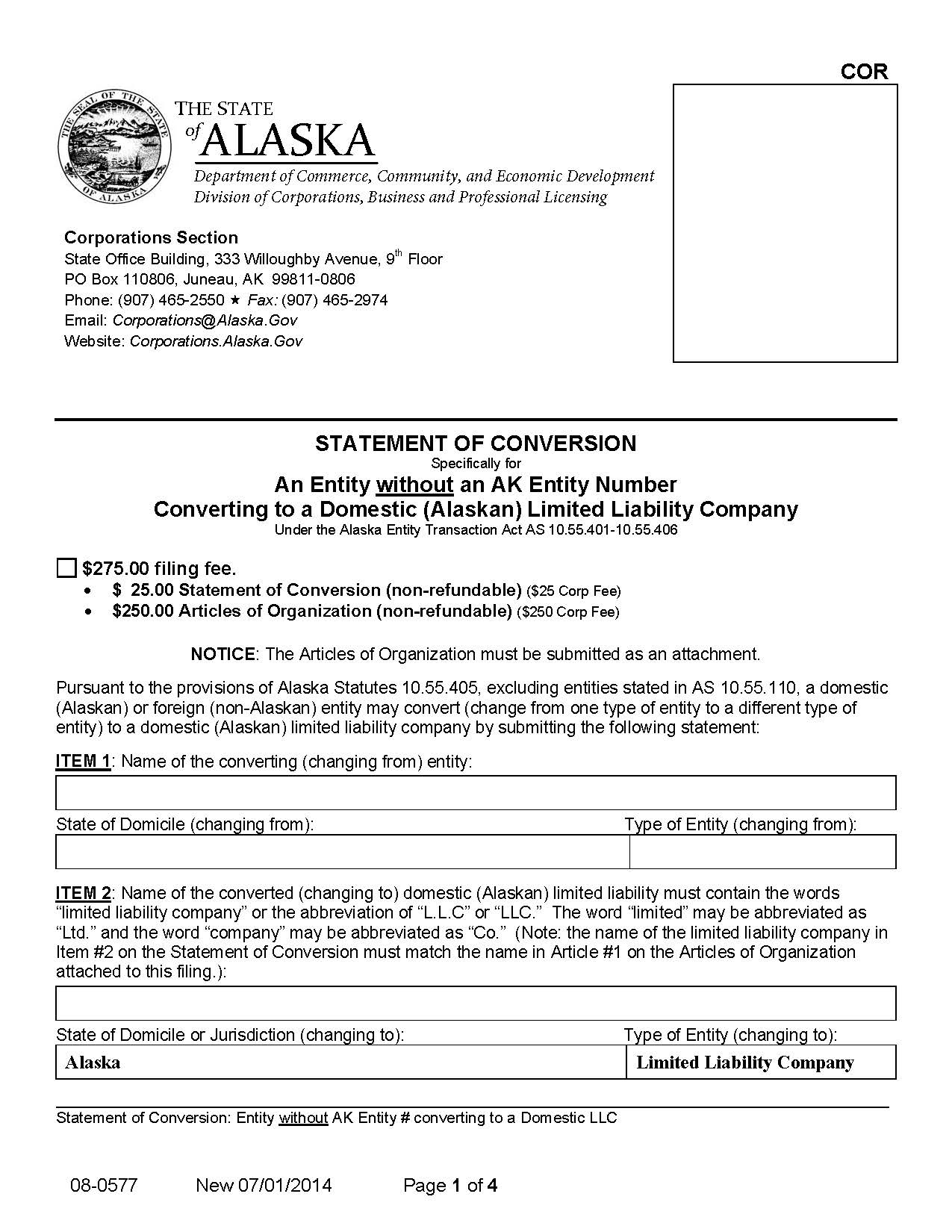

Statement Of Conversion Entity Without AK Number Converting To Dom LLC {08-0577}

Start Your Free Trial $ 29.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

08-0577 - STATEMENT OF CONVERSION: ENTITY WITHOUT AN AK ENTITY NUMBER CONVERTING TO A DOMESTIC (ALASKAN) LIMITED LIABILITY COMPANY. This form is used to legally change the structure of an existing out-of-state or non-Alaskan business entity into a domestic Alaska limited liability company (LLC). It is governed by Alaska statutes AS 10.55.401–10.55.406 and AS 10.50.075, and is intended for businesses that do not yet have an Alaska Entity Number. The filing requires a $275.00 fee, which includes both the $25.00 for the Statement of Conversion and $250.00 for filing the Articles of Organization for the newly formed LLC. The form must include the name and jurisdiction of the original entity, the name of the new LLC, and optionally a future effective date for the conversion (not more than 90 days from filing). The applicant must also attach the LLC’s Articles of Organization, which outline the new business's name, purpose, NAICS code, registered agent, management structure, and any optional provisions. These articles must comply with Alaska law and match the information on the Statement of Conversion. The form must be signed by an authorized representative of the converting entity, and the submission must include both the form and the applicable payment. Once filed and processed—typically within 10 to 15 business days—the business must also file an Initial Report with the Alaska Corporations Section. The form includes details on optional future actions such as securing a business license or complying with Alaska's corporate tax laws. www.FormsWorkflow.com

Related forms

-

Articles Of Merger Business Professional Non Profit Or Cooperative Corporation

Articles Of Merger Business Professional Non Profit Or Cooperative Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Application For Certificate Of Limited Partnership

Application For Certificate Of Limited Partnership

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Incorporation (Domestic Cooperative Corporation)

Articles Of Incorporation (Domestic Cooperative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Certificate Of Authority (Foreign Nonprofit Corporation)

Amended Certificate Of Authority (Foreign Nonprofit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Amendment (Domestic Cooperative Corporation)

Articles Of Amendment (Domestic Cooperative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Consolidation (Domestic Business Corporation)

Articles Of Consolidation (Domestic Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Incorporation (Domestic Business Corporation)

Articles Of Incorporation (Domestic Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Authority (Foreign Business Corporation)

Certificate Of Authority (Foreign Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Consolidation (Domestic Cooperative Corporation)

Articles Of Consolidation (Domestic Cooperative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended And Restated Articles Of Incorporation (Domestic Nonprofit Corporation)

Amended And Restated Articles Of Incorporation (Domestic Nonprofit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Authority (Foreign Coopoerative Corporation)

Certificate Of Authority (Foreign Coopoerative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Amendment (Domestic Professional Corporation)

Articles Of Amendment (Domestic Professional Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation (All Entity Types)

Registered Agent Notice Of Resignation (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation (All Entity Types)

Registered Agent Notice Of Resignation (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Merger (Foreign Nonprofit Corporation)

Notification Of Merger (Foreign Nonprofit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Restated Articles Of Incorporation (Domestic Nonprofit Corporation)

Restated Articles Of Incorporation (Domestic Nonprofit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation

Registered Agent Notice Of Resignation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Merger (Foreign Cooperative Corporation)

Notification Of Merger (Foreign Cooperative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Consolidation (Foreign Nonprofit Corporation)

Notification Of Consolidation (Foreign Nonprofit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Consolidation (Foreign LLC)

Notification Of Consolidation (Foreign LLC)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Consolidation (Foreign Cooperative Corporation)

Notification Of Consolidation (Foreign Cooperative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Foreign LLC)

Notice Of Change Of Officials (Foreign LLC)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Certificate Of Authority Foreign Business Corporation

Amended Certificate Of Authority Foreign Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Amendment Religious Corporation

Articles Of Amendment Religious Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Consolidation Limited Liability Company

Articles Of Consolidation Limited Liability Company

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

New Business Name Registration

New Business Name Registration

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Restated Articles Of Incorporation Domestic Business Corporation

Restated Articles Of Incorporation Domestic Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Trademark Registration (New Application Only)

Trademark Registration (New Application Only)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Assignment Of Trademark (Assignment Form Only)

Assignment Of Trademark (Assignment Form Only)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Abandonment Of Plan Of Domestication

Statement Of Abandonment Of Plan Of Domestication

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Domestic Entity Domesticating To A Non Qualified Foreign Entity)

Statement Of Domestication (Domestic Entity Domesticating To A Non Qualified Foreign Entity)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended And Restated Articles Of Incorporation (Domestic Cooperative)

Amended And Restated Articles Of Incorporation (Domestic Cooperative)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Domestic Electric Or Telephone Cooperatives)

Notice Of Change Of Officials (Domestic Electric Or Telephone Cooperatives)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

New Business Name Reservation

New Business Name Reservation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Renewal Business Name Reservation

Renewal Business Name Reservation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Transfer Business Name Reservation

Transfer Business Name Reservation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Certificate Of Registration (Foreign Limited Liability Company)

Amended Certificate Of Registration (Foreign Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Incorporation (Domestic Religious Corporations){08-539}

Articles Of Incorporation (Domestic Religious Corporations){08-539}

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Statement Of Foreign Qualification (Foreign LLP)

Amended Statement Of Foreign Qualification (Foreign LLP)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Statement Of Qualification (Domestic Limited Liability Partnership)

Amended Statement Of Qualification (Domestic Limited Liability Partnership)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Amendment (Domestic Business Corporation)

Articles Of Amendment (Domestic Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Amendment (Domestic Limited Liability Company)

Articles Of Amendment (Domestic Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Organization (Domestic Limited Liability Company)

Articles Of Organization (Domestic Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Registration (Foreign Limited Liability Company)

Certificate Of Registration (Foreign Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Merger (Foreign Business Corporation)

Notification Of Merger (Foreign Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Merger (Foreign Limited Liability Company)

Notification Of Merger (Foreign Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation (All Entity Types)

Registered Agent Notice Of Resignation (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation (All Entity Types)

Registered Agent Notice Of Resignation (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation (All Entity Types)

Registered Agent Notice Of Resignation (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Staement Of Domestication (Foreign Corp With AK Entity No. Domesticating To Domestic Corp.)

Staement Of Domestication (Foreign Corp With AK Entity No. Domesticating To Domestic Corp.)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Abandonment Of Plan Of Interest Exchange (All Entity Types)

Statement Of Abandonment Of Plan Of Interest Exchange (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Abandonment Of Plan Of Merger (All Entity Types)

Statement Of Abandonment Of Plan Of Merger (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Restated Articles Of Organization (Domestic Limited Liability Company)

Restated Articles Of Organization (Domestic Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction (All Entity Types)

Certificate Of Correction (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Registered Agent Notice Of Resignation (All Entity Types)

Registered Agent Notice Of Resignation (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Renew Business Name Registration

Renew Business Name Registration

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Foreign Business Corporation)

Notice Of Change Of Officials (Foreign Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Foreign Cooperative)

Notice Of Change Of Officials (Foreign Cooperative)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notification Of Consolidation (Foreign Business Corporation)

Notification Of Consolidation (Foreign Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended And Restated Articles Of Incorporation (Domestic Business Corp)

Amended And Restated Articles Of Incorporation (Domestic Business Corp)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Certificate Of Authority (Foreign Cooperative Corporation)

Amended Certificate Of Authority (Foreign Cooperative Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion (Entity With An AK Number Converting To Dom. LLC)

Statement Of Conversion (Entity With An AK Number Converting To Dom. LLC)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (A Foreign LLC Without AK Number Domesticating To LLC)

Statement Of Domestication (A Foreign LLC Without AK Number Domesticating To LLC)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Domestic Bus. Corp. Domesticating To Foreign Bus. Corp.)

Statement Of Domestication (Domestic Bus. Corp. Domesticating To Foreign Bus. Corp.)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Domestic LLC Domesticating To Foreign LLC)

Statement Of Domestication (Domestic LLC Domesticating To Foreign LLC)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Foreign Bus Corp Without AK Entity Number To Domestic Corp)

Statement Of Domestication (Foreign Bus Corp Without AK Entity Number To Domestic Corp)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Foreign LLC With AK Entity Number Domesticating To LLC)

Statement Of Domestication (Foreign LLC With AK Entity Number Domesticating To LLC)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Limited Partnership Which Will Continue Conducting Bus. As LP)

Statement Of Domestication (Limited Partnership Which Will Continue Conducting Bus. As LP)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (LLP To Continue Conducting Bus. In Alaska As Qualified LLP)

Statement Of Domestication (LLP To Continue Conducting Bus. In Alaska As Qualified LLP)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Foreign Qualification (Foreign LLP)

Statement Of Foreign Qualification (Foreign LLP)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Interest Exchange (All Entity Types)

Statement Of Interest Exchange (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Merger (All Entity Types)

Statement Of Merger (All Entity Types)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Qualification (Domestic Limited Liability Partnership)

Statement Of Qualification (Domestic Limited Liability Partnership)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Amendment Domestic Limited Liability Company

Articles Of Amendment Domestic Limited Liability Company

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Restated Certificate Of Limited Partnership For Domestic LP

Restated Certificate Of Limited Partnership For Domestic LP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Registration For Foreign Limited Partnership

Certificate Of Registration For Foreign Limited Partnership

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended And Restated Articles Of Incorporation (Domestic Professional Corp)

Amended And Restated Articles Of Incorporation (Domestic Professional Corp)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Foreign Non Profit Corporation)

Notice Of Change Of Officials (Foreign Non Profit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Correction Of Statement To Registration (Foreign Limited Partnership)

Correction Of Statement To Registration (Foreign Limited Partnership)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Domestication (Foreign Corp With AK Entity No. Domesticating To Domestic Corp.)

Statement Of Domestication (Foreign Corp With AK Entity No. Domesticating To Domestic Corp.)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Amended Certificate Of Limited Partnership Domestic LP

Amended Certificate Of Limited Partnership Domestic LP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Merger Domestic Business Corp

Articles Of Merger Domestic Business Corp

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Merger Limited Liability Company

Articles Of Merger Limited Liability Company

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Correction All Entity Types

Certificate Of Correction All Entity Types

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Merger Domestic Professional Corporation

Articles Of Merger Domestic Professional Corporation

Alaska/5 Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Merger Domestic Non Profit Corporation

Articles Of Merger Domestic Non Profit Corporation

Alaska/5 Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Merger Domestic Cooperative Corporation

Articles Of Merger Domestic Cooperative Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Dissolution Domestic Religous Corporation

Articles Of Dissolution Domestic Religous Corporation

Alaska/5 Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Election To Dissolve Domestic Religous Corporation

Certificate Of Election To Dissolve Domestic Religous Corporation

Alaska/5 Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Cancellation Domestic Limited Liability Partnership

Statement Of Cancellation Domestic Limited Liability Partnership

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Cancellation Domestic LP

Certificate Of Cancellation Domestic LP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Dissolution Domestic Limited Liability Company

Articles Of Dissolution Domestic Limited Liability Company

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Dissolution Domestic Cooperative Corporation

Articles Of Dissolution Domestic Cooperative Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Intent To Dissolve Domestic Cooperative Corporation

Statement Of Intent To Dissolve Domestic Cooperative Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Dissolution Domestic Non Profit Corporation

Articles Of Dissolution Domestic Non Profit Corporation

Alaska/5 Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Dissolution Domestic Professional Corporation

Articles Of Dissolution Domestic Professional Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Election To Dissolve Domestic Professional Corporation

Certificate Of Election To Dissolve Domestic Professional Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Articles Of Dissolution Domestic Business Corporation

Articles Of Dissolution Domestic Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Election To Dissolve Domestic Business Corporation

Certificate Of Election To Dissolve Domestic Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Withdrawal Foreign Cooperative Corporation

Certificate Of Withdrawal Foreign Cooperative Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Cancellation Foreign Limited Partnership

Certificate Of Cancellation Foreign Limited Partnership

Alaska/5 Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Cancellation Foreign LLP

Statement Of Cancellation Foreign LLP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Withdrawal Foreign Nonprofit Corporation

Certificate Of Withdrawal Foreign Nonprofit Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Withdrawal Foreign Business Corporation

Certificate Of Withdrawal Foreign Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Request A License Verification

Request A License Verification

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Certificate Of Cancellation Foreign LLC

Certificate Of Cancellation Foreign LLC

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Change Of Registrant Information Of Trademark

Change Of Registrant Information Of Trademark

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Foreign Corporation Name Registration

Foreign Corporation Name Registration

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Service Mark Registration New Application Only

Service Mark Registration New Application Only

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Foreign Non Alaskan LP

Statement Of Conversion Foreign Non Alaskan LP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Entity Without AK Number Converting To Domestic

Statement Of Conversion Entity Without AK Number Converting To Domestic

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Entity AK Number Converting To Domestic Bus Corp

Statement Of Conversion Entity AK Number Converting To Domestic Bus Corp

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic LP Converting To Any Other Entity

Statement Of Conversion Domestic LP Converting To Any Other Entity

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic Entity Without AK Number Converting To Foreign LLC

Statement Of Conversion Domestic Entity Without AK Number Converting To Foreign LLC

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic Entity Without AK Number Converting To Foreign

Statement Of Conversion Domestic Entity Without AK Number Converting To Foreign

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic Entity With AK Number Converting To Foreign

Statement Of Conversion Domestic Entity With AK Number Converting To Foreign

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic Entity With AK Number Converting To Foreign

Statement Of Conversion Domestic Entity With AK Number Converting To Foreign

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic Entity Converting To Foreign LLP

Statement Of Conversion Domestic Entity Converting To Foreign LLP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Domestic Entity Converting To A Non Qualified Entity

Statement Of Conversion Domestic Entity Converting To A Non Qualified Entity

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Any Entity Converting To Domestic LP

Statement Of Conversion Any Entity Converting To Domestic LP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Any Entity Converting To Domestic LLP

Statement Of Conversion Any Entity Converting To Domestic LLP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Conversion Entity Without AK Number Converting To Dom LLC

Statement Of Conversion Entity Without AK Number Converting To Dom LLC

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Abandonment Of Plan Of Conversion

Statement Of Abandonment Of Plan Of Conversion

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Trademark Registration Renewal Renewal Application Only

Trademark Registration Renewal Renewal Application Only

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Foreign LLP

Statement Of Change Foreign LLP

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Foreign LLC

Statement Of Change Foreign LLC

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Foreign Cooperative

Statement Of Change Foreign Cooperative

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Foreign Business Corporation

Statement Of Change Foreign Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Religious Corporation

Statement Of Change Domestic Religious Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Professional Corporation

Statement Of Change Domestic Professional Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Non Profit Corporation

Statement Of Change Domestic Non Profit Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Limited Partnership

Statement Of Change Domestic Limited Partnership

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change (Domestic Limited Liability Partnership)

Statement Of Change (Domestic Limited Liability Partnership)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Limited Liability Company

Statement Of Change Domestic Limited Liability Company

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Electric Or Telephone Cooperatives

Statement Of Change Domestic Electric Or Telephone Cooperatives

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Cooperative

Statement Of Change Domestic Cooperative

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Statement Of Change Domestic Business Corporation

Statement Of Change Domestic Business Corporation

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Domestic Business Corporation)

Notice Of Change Of Officials (Domestic Business Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Domestic Cooperative)

Notice Of Change Of Officials (Domestic Cooperative)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Domestic Limited Liability Company)

Notice Of Change Of Officials (Domestic Limited Liability Company)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Domestic Non-profit Corporation)

Notice Of Change Of Officials (Domestic Non-profit Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/ -

Notice Of Change Of Officials (Domestic Professional Corporation)

Notice Of Change Of Officials (Domestic Professional Corporation)

Alaska/Secretary Of State/Division Of Banking Securities And Corporations/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!