Last updated: 4/28/2023

Guardianship Report EZ Accounting Form {11800}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

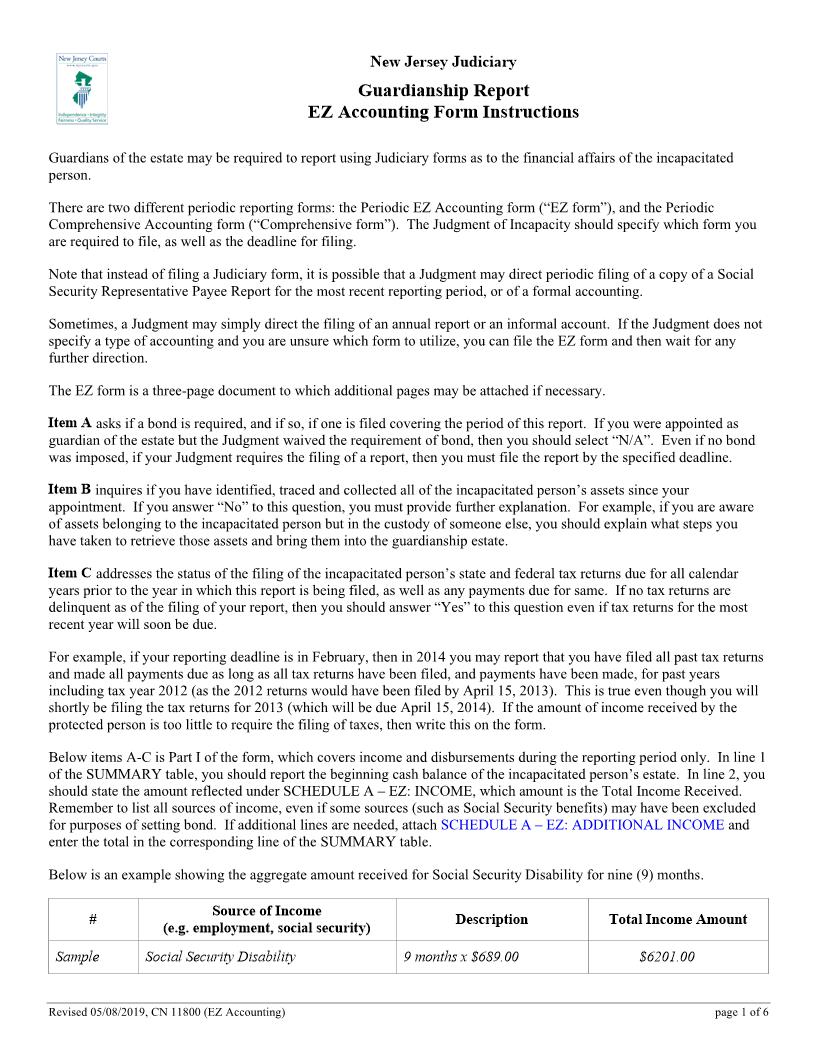

Instructions - EZ Accounting Two different reporting forms have been prepared for use by guardians of the estate, the EZ Accounting form, and the Comprehensive Accounting form. If you were appointed as guardian after the publication of these forms in 2014, then the Judgment of Incapacity should specify which form you are required to file, as well as the deadline for filing. If you were appointed as guardian of an incapacitated person's estate prior to 2014, then the Judgment of Incapacity may simply direct the filing of an annual report. To determine whether you must file any report as to the estate of the incapacitated person, look to the Judgment to see if you were appointed as guardian of the person only, or as guardian of the person and estate (or person and property). Unless you were appointed as guardian of the person only, your reporting requirement includes a requirement to report as to the estate of the incapacitated person. The only exception to this rule is if you were appointed as guardian of the person and estate but the Judgment specifies that no letters of guardianship of the estate (or no letters of guardianship of the property) will issue absent further application to the Superior Court. If the Judgment does not specify a type of accounting and you are unsure which form to utilize, you can file the EZ Accounting and then wait for any further direction from the Guardianship Monitoring Program and/or court staff. The EZ Accounting form is a three-page document to which additional pages may be attached if necessary. Item 1 asks if a bond is required, and if so, if one is filed covering the period of this report. If you were appointed as guardian of the estate but the Judgment waived the requirement of bond, then you should select "N/A". Even if no bond was imposed, if your Judgment requires the filing of a report, then you must file the report by the specified deadline. Item 2 inquires if you have identified, traced and collected all of the incapacitated person's assets since your appointment. If you answer "No" to this question, you must provide further explanation. For example, if you are aware of assets belonging to the incapacitated person but in the custody of someone else, you should explain what steps you have taken to retrieve those assets and bring them into the guardianship estate. Item 3 addresses the status of the filing of the incapacitated person's past and current state and federal tax returns, as well as tax payments. If no tax returns are delinquent as of the filing of your report, then you should answer yes to this question even if tax returns for a subsequent year will soon be due. For example, if your reporting deadline is in February, then in 2014 you may report that you have filed all past and current returns and made all payments if everything is current through 2013, even though you will shortly be filing the 2014 returns. Below items 1-3 is a SUMMARY table. In the line numbered 4, you should report the beginning cash balance of the incapacitated person's estate. In line 5, you should state the amount reflected under SCHEDULE A - EZ: INCOME, which amount is the Total Income Received. Remember to list all sources of income, even if some sources (such as Social Security benefits) may have been excluded for purposes of setting bond. Below is an example showing the aggregate amount received for Social Security Disability for nine (9) months. Line Number Source of Income (e.g. employment, social security) Description (e.g. number of months times dollar amount) Total Income Amount Sample Social Security Disability 9 months x $689.00 $6201.00 If you are required to report annually, then income will generally cover twelve (12) months. You may wish to add a brief explanation if certain income is received for a shorter period of time (i.e., the incapacitated person participates through school in a structured work program for ten (10) months of the year, earning a stipend of $100/month for that 10-month period, for a total of $1000/year, but the incapacitated person has no earned income during the other two (2) months of the year). Revised: 04/2015, CN:11800 (Guardianship - EZ Accounting Instructions) page 1 of 3 American LegalNet, Inc. www.FormsWorkFlow.com Instructions - EZ Accounting Schedule B-EZ: DISBURSEMENTS should reflect the payments made from the guardianship estate for the reporting period. Some disbursements, like food and utilities, are for regular, recurring expenses. If food is purchased solely for the incapacitated person, then the amount spent will likely vary from month to month. In this situation, the category of disbursements should be reported on a monthly basis, but it is not necessary to list check numbers or dates of purchase. The following is sufficient: Line Number Category Check Number Payment Date Payee Amount Spent 1 2 3 Monthly Grocery - January Monthly Grocery - February Monthly Grocery - March Jan. 2014 ACME / Shoprite Feb. 2014 Shoprite March 2014 ACME $293.77 $301.23 $256.85 If the incapacitated person resides with the guardian(s) as part of a family unit, then it is permissible for a set amount of the incapacitated person's funds to be utilized each month to cover his or her share of food purchases. In this case, for SCHEDULE B-EZ, you may report as follows: Line Number Category Check Number Payment Date Payee Amount Spent 1 Grocery - 12 monthes auto-debit Jan - Dec. 2014 ACME/Shoprite 12 x $225/mo = $2700 Other recurring monthly expenses, like a cell phone or cable plan, can also be reported in this manner. Line Number Category Check Number Payment Date Payee Amount Spent 1 Jitterbug Plus (cellphone basic plan 29) auto-debit Jan - Dec. 2014 Sprint 12 x $29.99/mo = $359.88 Some disbursements will reflect occasional purchases, such as new clothes at the beginning of a season or for special events. For these items, all fields of the SCHEDULE B-EZ: DISBURSEMENTS should be completed, as follows: Line Number Category Check Number Payment Date Payee Amount Spent 1 2 Clothing (winter coat, gloves, snow boots) Clothing (sister's wedding) Jan. 2014 Feb. 2014 ACME / Shoprite Shoprite $293.77 $301.23 Keep in mind that reports are reviewed through the New Jersey Guardianship Monitoring Program. While the forms are designed for simplicity and ease of use, if the entries are unclear or raise questions in the minds of reviewers, then you may be asked to provide further explanation or substantiation. The next section of the report