Last updated: 11/1/2022

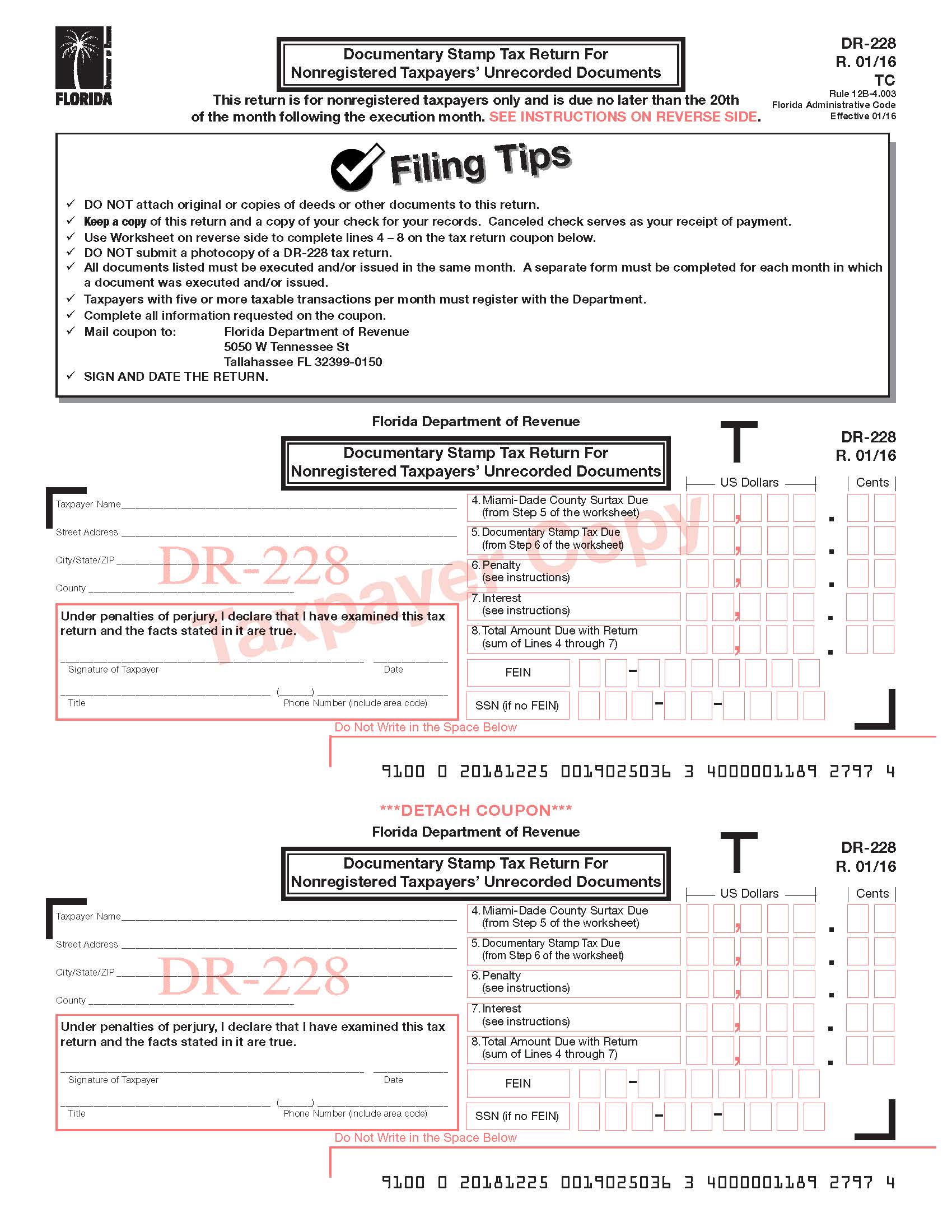

Documentary Stamp Tax Return For Nonregistered Taxpayers Unrecorded Documents {DR-228}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DR-228 - DOCUMENTARY STAMP TAX RETURN FOR NONREGISTERED TAXPAYERS’ UNRECORDED DOCUMENTS. This is a Florida Department of Revenue form used by individuals and entities that are not registered with the Department to report and pay documentary stamp tax on certain unrecorded documents. This form applies when a taxpayer has fewer than five taxable transactions per month and the document is executed or issued in Florida but not recorded with a clerk of court. Common taxable documents include notes, written obligations to pay money, bonds, leases with an unconditional promise to pay, and certain transfers of real property interest. The return and payment are due by the 20th day of the month following execution. Each DR-228 covers documents executed within the same month and must be signed under penalties of perjury. www.FormsWorkflow.com