Last updated: 11/18/2022

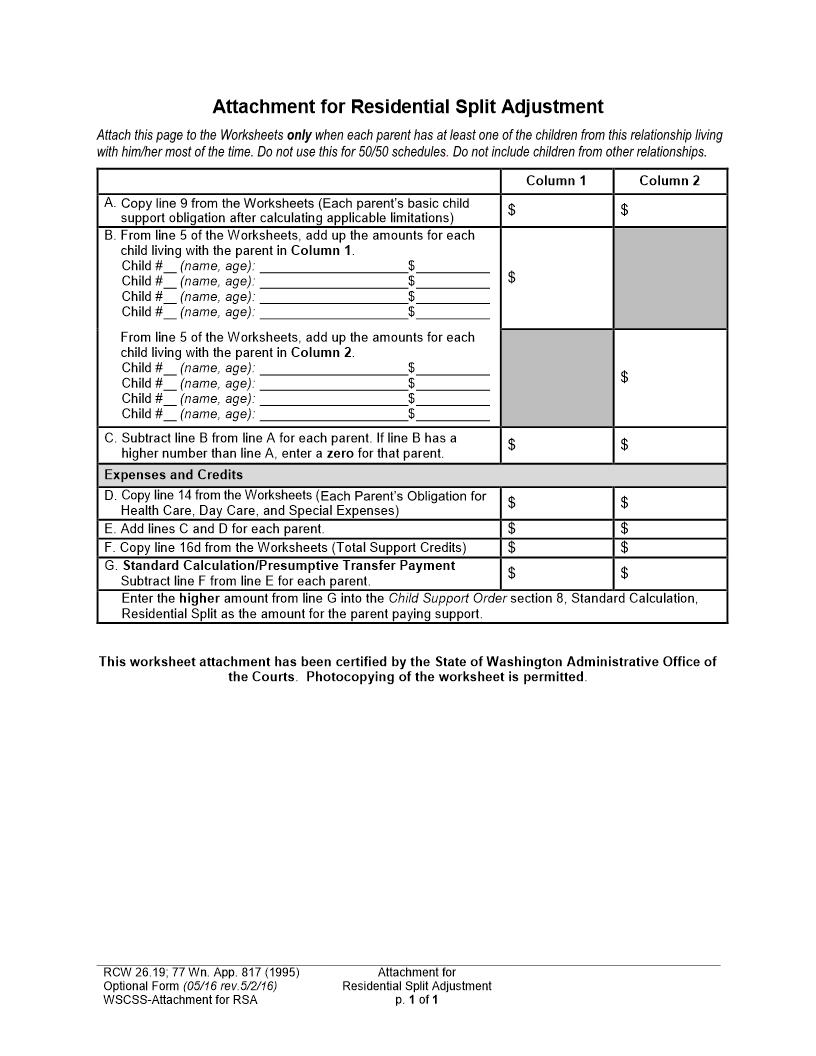

Attachment For Residential Split Adjustment

Start Your Free Trial $ 6.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Washington State Child Support Schedule Worksheets Or, Proposed by (name) ___________________ State of WA Signed by the Judicial/Reviewing Officer. (CSW) Other _______________. (CSWP) County Child/ren and Age/s: Parents' names: Case No. (Column 1) Column 1 (Column 2) Column 2 Part I: Income (see Instructions, page 6) 1. Gross Monthly Income a. Wages and Salaries b. Interest and Dividend Income c. Business Income d. Maintenance Received e. Other Income f. Imputed Income g. Total Gross Monthly Income (add lines 1a through 1f) 2. Monthly Deductions from Gross Income a. Income Taxes (Federal and State) b. FICA (Soc. Sec.+ Medicare)/Self-Employment Taxes c. State Industrial Insurance Deductions d. Mandatory Union/Professional Dues e. Mandatory Pension Plan Payments f. Voluntary Retirement Contributions g. Maintenance Paid h. Normal Business Expenses i. Total Deductions from Gross Income (add lines 2a through 2h) 3. Monthly Net Income (line 1g minus 2i) 4. Combined Monthly Net Income (add both parents' monthly net incomes from line 3) 5. Basic Child Support Obligation (enter total amount in box ) Child #1 _________ Child #3 __________ Child #5 __________ Child #2 _________ Child #4 __________ 6. Proportional Share of Income (divide line 3 by line 4 for each parent) WSCSS-Worksheets - Mandatory (CSW/CSWP) 05/2016 Page 1 of 5 American LegalNet, Inc. www.FormsWorkFlow.com $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ . . Column 1 Part II: Basic Child Support Obligation (see Instructions, page 7) 7. Each Parent's Basic Child Support Obligation without consideration of low income limitations. (Multiply each number on line 6 by line 5.) 8. Calculating low income limitations: Fill in only those that apply. Self-Support Reserve: (125% of the Federal Poverty Guideline.) a. Is Combined Net Income Less Than $1,000? If yes, for each parent enter the presumptive $50 per child. b. Is Monthly Net Income Less Than Self-Support Reserve? If yes, for that parent enter the presumptive $50 per child. c. Is Monthly Net Income equal to or more than Self-Support Reserve? If yes, for each parent subtract the self-support reserve from line 3. If that amount is less than line 7, enter that amount or the presumptive $50 per child, whichever is greater. 9. Each parent's basic child support obligation after calculating applicable limitations. For each parent, enter the lowest amount from line 7, 8a - 8c, but not less than the presumptive $50 per child. $ $ $ $ $ $ $ Column 2 $ $ $ $ Part III: Health Care, Day Care, and Special Child Rearing Expenses (see Instructions, page 8) 10. Health Care Expenses a. Monthly Health Insurance Premiums Paid for Child(ren) b. Uninsured Monthly Health Care Expenses Paid for Child(ren) c. Total Monthly Health Care Expenses (line 10a plus line 10b) d. Combined Monthly Health Care Expenses (add both parents' totals from line 10c) 11. Day Care and Special Expenses a. Day Care Expenses b. Education Expenses c. Long Distance Transportation Expenses d. Other Special Expenses (describe) $ $ $ $ $ $ $ e. Total Day Care and Special Expenses (add lines 11a through 11d) 12. Combined Monthly Total Day Care and Special Expenses (add both parents' day care and special expenses from line 11e) 13. Total Health Care, Day Care, and Special Expenses (line 10d plus line 12) 14. Each Parent's Obligation for Health Care, Day Care, and Special Expenses (multiply each number on line 6 by line 13) Part IV: Gross Child Support Obligation 15. Gross Child Support Obligation (line 9 plus line 14) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ WSCSS-Worksheets - Mandatory (CSW/CSWP) 05/2016 Page 2 of 5 American LegalNet, Inc. www.FormsWorkFlow.com Column 1 Part V: Child Support Credits (see Instructions, page 9) 16. Child Support Credits a. Monthly Health Care Expenses Credit b. Day Care and Special Expenses Credit c. Other Ordinary Expenses Credit (describe) $ $ $ $ Column 2 $ d. Total Support Credits (add lines 16a through 16c) 17. Standard Calculation (line 15 minus line 16d or $50 per child whichever is greater) Part VII: Additional Informational Calculations 18. 45 % of each parent's net income from line 3 (.45 x amount from line 3 for each parent) 19. 25% of each parent's basic support obligation from line 9 (.25 x amount from line 9 for each parent) $ $ $ $ $ Part VI: Standard Calculation/Presumptive Transfer Payment (see Instructions, page 9) $ $ $ $ Part VIII: Additional Factors for Consideration (see Instructions, page 9) 20. Household Assets (List the estimated present value of all major household assets.) a. Real Estate b. Investments c. Vehicles and Boats d. Bank Accounts and Cash e. Retirement Accounts f. Other (describe) 21. Household Debt (List liens against household assets, extraordinary debt.) $ $ $ $ $ 22. Other Household Income a. Income Of Current Spouse or Domestic Partner (if not the other parent of this action) Name __________________________________________ Name __________________________________________ b. Income Of Other Adults In Household Name __________________________________________ Name __________________________________________ WSCSS-Worksheets - Mandatory (CSW/CSWP) 05/2016 Page 3 of 5 American LegalNet, Inc. www.FormsWorkFlow.com $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Column 1 c. Gross income from overtime or from second jobs the party is asking the court to exclude per Instructions, page 8 _________________________________________________ d. Income Of Child(ren) (if considered extraordinary) Name __________________________________________ Name __________________________________________ e. Income From Child Support Name __________________________________________ Name __________________________________________ f. Income From Assistance Programs Program ________________________________________ Program ________________________________________ g. Other Income (describe) ________________________________________________ ________________________________________________ 23. Non-Recurring Income (describe) _________________________________________________ _________________________________________________ 24. Child Support Owed, Monthly, for Biological or Legal Child(ren) Name/age: _____________________________ Paid [ ] Yes [ ] No Name/age: _____________________________ Paid [ ] Yes [ ] No Name/age: _____________________________ Paid [ ] Yes [ ] No 25. Other Child(ren) Living In Each Household (First name(s) and age(s)) $ $ $ $ $ $ Column 2 $ $