Last updated: 1/7/2012

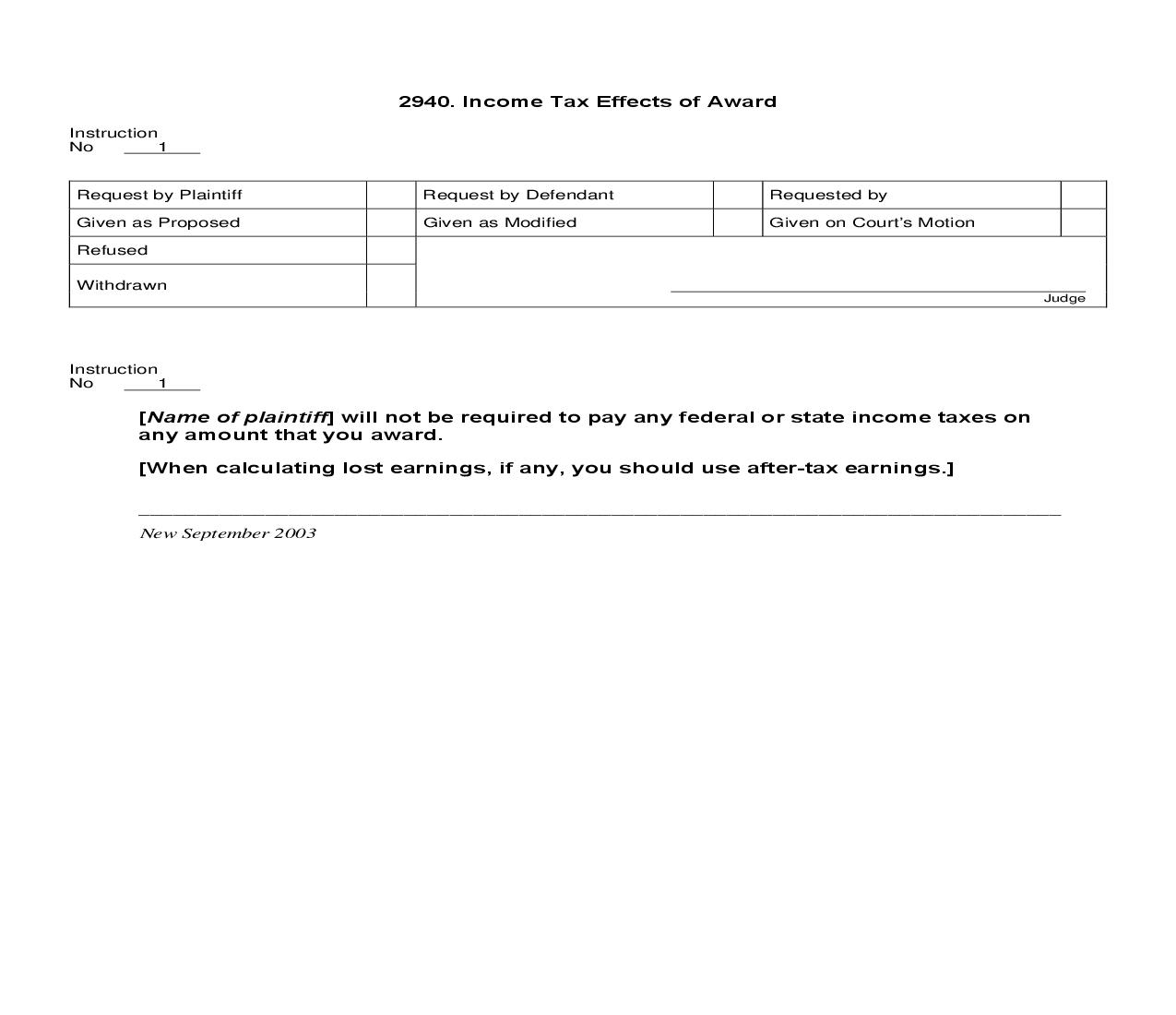

2940. Income Tax Effects of Award

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

2940. Income Tax Effects of Award Instruction No 1 Request by Plaintiff Given as Proposed Refused Withdrawn Request by Defendant Given as Modified Requested by Given on Court's Motion Judge Instruction No 1 [Name of plaintiff] will not be required to pay any federal or state income taxes on any amount that you award. [When calculating lost earnings, if any, you should use after-tax earnings.] ________________________________________________________________________________ New September 2003

Related forms

Our Products