Last updated: 4/13/2015

Sales And Use Tax Return {E-500}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

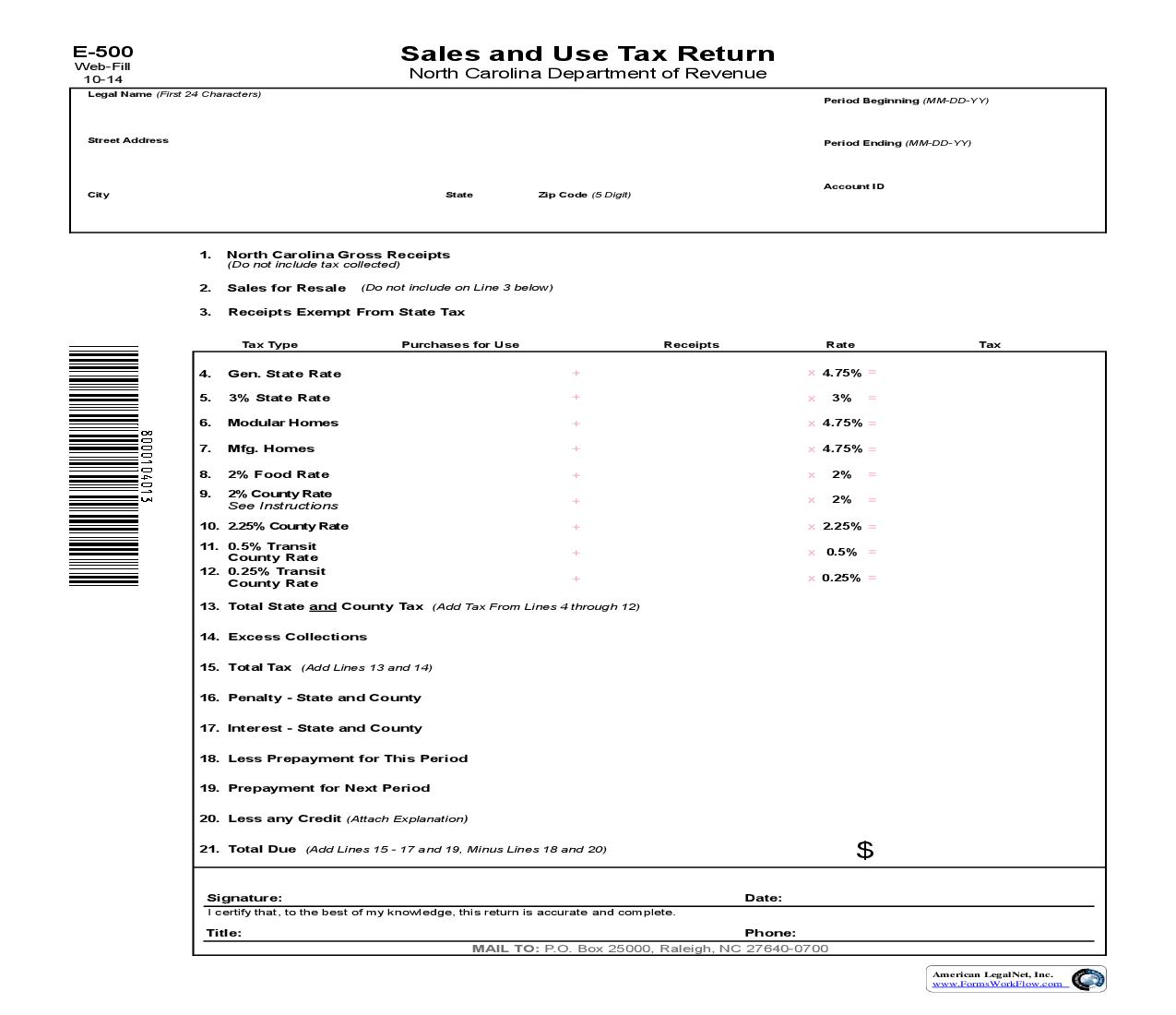

E-500 Web-Fill 10-11 Legal Name (First 24 Characters) Sales and Use Tax Return North Carolina Department of Revenue Period Beginning (MM-DD-YY) Street Address Period Ending (MM-DD-YY) City State Zip Code (5 Digit) Account ID 1. North Carolina Gross Receipts (Do not include tax collected) 2. Sales for Resale (Do not include on Line 3 below) 3. Receipts Exempt From State Tax Tax Type Purchases for Use Receipts Rate Tax 4. 5. 6. 7. 8. 9. Gen. State Rate 3% State Rate 2.5% State Rate Modular Homes + + + + + + + + + x 4.75% = x 3% = x 2.5% = x x x 2% = 2% = 2% = 2% State Rate 2% Food Rate 2% County Rate See Instructions 10. 2.25% County Rate 11. 0.5% Transit County Rate 12. 0.25% Transit County Rate x 2.25% = x 0.5% = x 0.25% = 13. Total State and County Tax (Add Tax From Lines 4 through 12) 14. Excess Collections 15. Total Tax (Add Lines 13 and 14) 16. Penalty - State and County 17. Interest - State and County 18. Less Prepayment for This Period 19. Prepayment for Next Period 20. Less any Credit (Attach explanation) 21. Total Due (Add Lines 15 - 17 and 19, Minus Lines 18 and 20) $ Date: Phone: Signature: I certify that, to the best of my knowledge, this return is accurate and complete. Title: MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0700 American LegalNet, Inc. www.FormsWorkFlow.com