Last updated: 7/11/2012

Affidavit Federal Loss Mitigation Programs {JD-CL-114}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

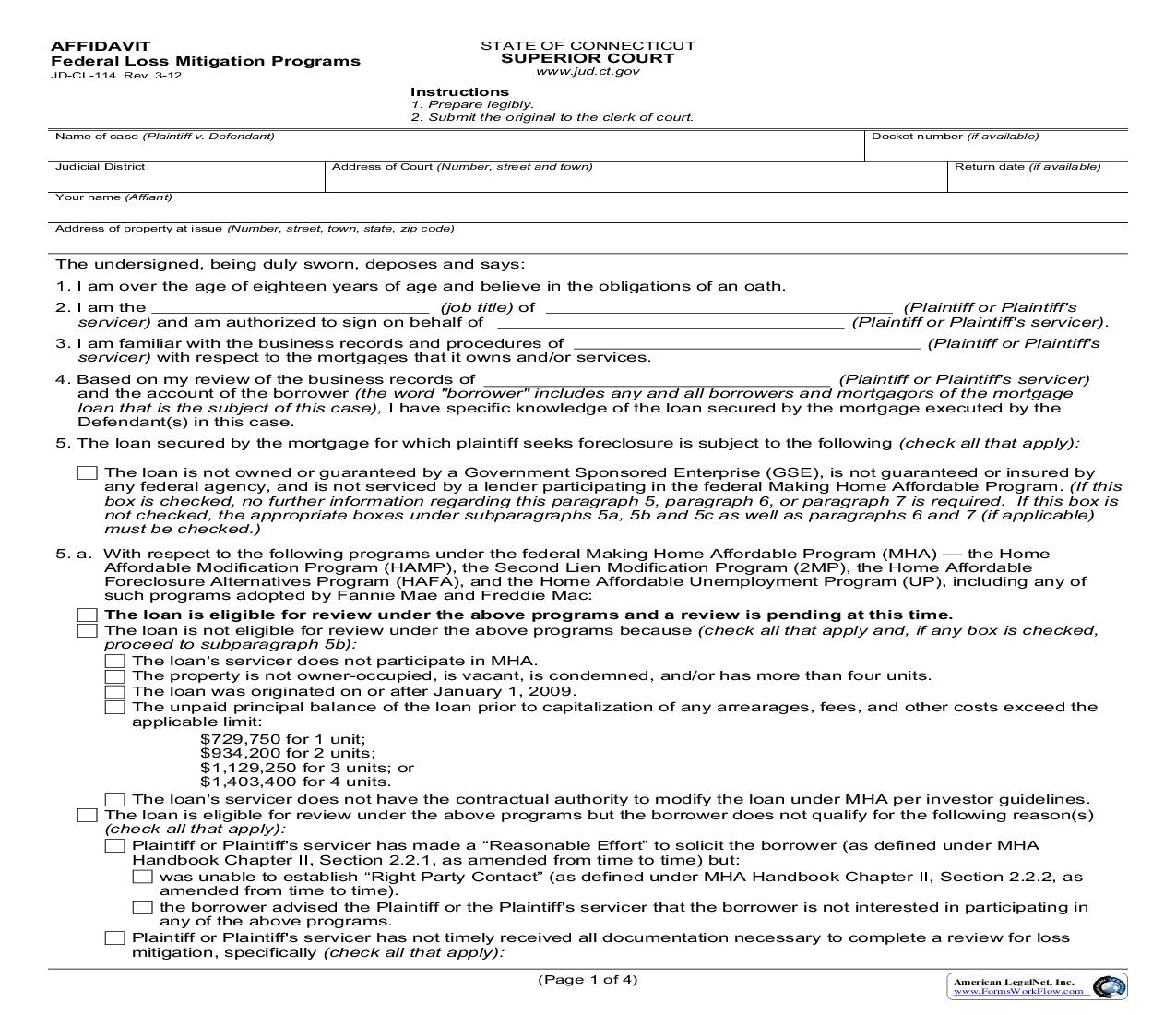

AFFIDAVIT Federal Loss Mitigation Programs JD-CL-114 Rev. 3-12 STATE OF CONNECTICUT SUPERIOR COURT www.jud.ct.gov Instructions 1. Prepare legibly. 2. Submit the original to the clerk of court. Name of case (Plaintiff v. Defendant) Docket number (if available) Judicial District Address of Court (Number, street and town) Return date (if available) Your name (Affiant) Address of property at issue (Number, street, town, state, zip code) The undersigned, being duly sworn, deposes and says: 1. I am over the age of eighteen years of age and believe in the obligations of an oath. 2. I am the (job title) of servicer) and am authorized to sign on behalf of 3. I am familiar with the business records and procedures of servicer) with respect to the mortgages that it owns and/or services. (Plaintiff or Plaintiff's (Plaintiff or Plaintiff's servicer). (Plaintiff or Plaintiff's 4. Based on my review of the business records of (Plaintiff or Plaintiff's servicer) and the account of the borrower (the word "borrower" includes any and all borrowers and mortgagors of the mortgage loan that is the subject of this case), I have specific knowledge of the loan secured by the mortgage executed by the Defendant(s) in this case. 5. The loan secured by the mortgage for which plaintiff seeks foreclosure is subject to the following (check all that apply): The loan is not owned or guaranteed by a Government Sponsored Enterprise (GSE), is not guaranteed or insured by any federal agency, and is not serviced by a lender participating in the federal Making Home Affordable Program. (If this box is checked, no further information regarding this paragraph 5, paragraph 6, or paragraph 7 is required. If this box is not checked, the appropriate boxes under subparagraphs 5a, 5b and 5c as well as paragraphs 6 and 7 (if applicable) must be checked.) 5. a. With respect to the following programs under the federal Making Home Affordable Program (MHA) -- the Home Affordable Modification Program (HAMP), the Second Lien Modification Program (2MP), the Home Affordable Foreclosure Alternatives Program (HAFA), and the Home Affordable Unemployment Program (UP), including any of such programs adopted by Fannie Mae and Freddie Mac: The loan is eligible for review under the above programs and a review is pending at this time. The loan is not eligible for review under the above programs because (check all that apply and, if any box is checked, proceed to subparagraph 5b): The loan's servicer does not participate in MHA. The property is not owner-occupied, is vacant, is condemned, and/or has more than four units. The loan was originated on or after January 1, 2009. The unpaid principal balance of the loan prior to capitalization of any arrearages, fees, and other costs exceed the applicable limit: $729,750 for 1 unit; $934,200 for 2 units; $1,129,250 for 3 units; or $1,403,400 for 4 units. The loan's servicer does not have the contractual authority to modify the loan under MHA per investor guidelines. The loan is eligible for review under the above programs but the borrower does not qualify for the following reason(s) (check all that apply): Plaintiff or Plaintiff's servicer has made a "Reasonable Effort" to solicit the borrower (as defined under MHA Handbook Chapter II, Section 2.2.1, as amended from time to time) but: was unable to establish "Right Party Contact" (as defined under MHA Handbook Chapter II, Section 2.2.2, as amended from time to time). the borrower advised the Plaintiff or the Plaintiff's servicer that the borrower is not interested in participating in any of the above programs. Plaintiff or Plaintiff's servicer has not timely received all documentation necessary to complete a review for loss mitigation, specifically (check all that apply): (Page 1 of 4) American LegalNet, Inc. www.FormsWorkFlow.com Proof of current income, specifically Completed IRS Form 4506-T or 4506T-EZ Dodd-Frank Certification Request for Modification and Affidavit Form Other: (specify) If none of the above reasons for disqualification are checked, please check all that apply under the following four sub-paragraphs: 5. a. 1. Specific to HAMP: The subject loan is not a first mortgage loan. (This denial reason applies to HAFA and UP as well). The total payment on the first mortgage (principal, interest, taxes, insurance, and association fees, if any) is less than 31% of the borrower's monthly gross income. (This denial reason applies to UP as well, unless the servicer has waived this requirement; with respect to Fannie Mae and Freddie Mac loans only, this denial reason applies to HAFA as well; for non-Fannie Mae and Freddie Mac loans, an additional denial reason must also be selected under HAFA.) Payment cannot be feasibly reduced to make it equal to 31% of the borrower's monthly gross income without requiring excessive forbearance. (If selected, denial reason must also be selected under HAFA). Net Present Value Calculation does not favor modification. (If selected, denial reason must also be selected under HAFA and UP). The borrower received a previous modification under HAMP effective (date) and failed to comply or defaulted. (If selected, denial reason must also be selected under HAFA; but this denial reason applies to UP as well). The borrower received a trial plan modification but failed to make each payment by the end of the month in which it was due. (If selected, denial reason must also be selected under HAFA; but this denial reason applies to UP as well). Other (specify) 5. a. 2. Specific to HAFA (Complete only if instructed above in sub-paragraph 5.a.1.): The borrower did not respond to HAFA solicitations. The borrower communicated that the borrower was not interested in pursuing HAFA. The borrower did not return the signed Short Sale Agreement. The borrower did not obtain a contract for sale within the time permitted under the program. Other (specify) 5. a. 3. Specific to 2MP (Complete only if this is a second lien): Corresponding first lien has not been modified under HAMP. 2nd lien has an unpaid balance of less than $5,000. 2nd lien has a pre-modification scheduled monthly payment of less than $100. 2nd lien has already been modified under 2MP. 2nd lien does not require payments until the first lien is paid in full. Insured, guaranteed or held by FHA//VA/Rural Development. Other (specify) 5. a. 4. Specific to UP: No borrower was unemployed on the date UP was requested. No borrower will receive unemployment benefits in the month of the UP